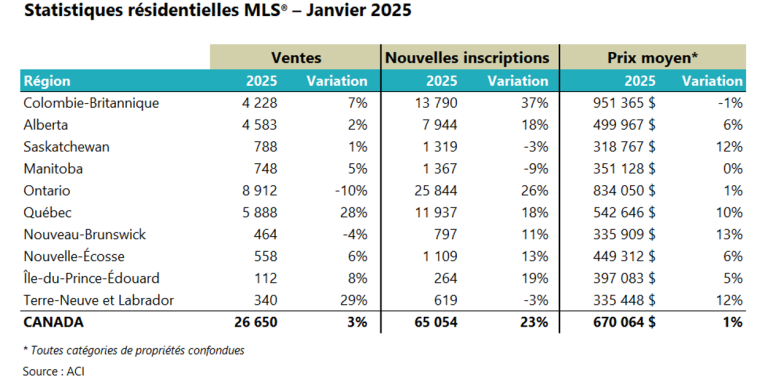

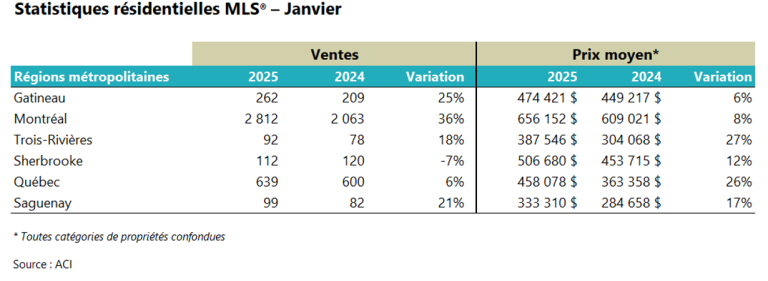

According to the latest resale market statistics published by the Canadian Real Estate Association (CREA) for January 2025, a total of 26,650 sales were recorded across Canada last month through various MLS® systems, representing a 3% increase compared to the same period in 2024. Quebec saw a 28% increase in sales, making it the second-highest growth among Canadian provinces, just slightly behind Newfoundland and Labrador (+29%).

The Quebec real estate market has been on an upward trend for several months now, with January’s sales increase following significant gains of 52% in December, 40% in November, and 34% in October.

Prices are also surging in the Quebec market. While prices have remained virtually stagnant over the past year in British Columbia (-1%) and Ontario (+1%), the average price of residential properties in Quebec saw a solid 10% increase between January 2024 and January 2025. Price increases are even more striking in markets east of the metropolis, particularly in the metropolitan areas of Trois-Rivières (+27%), Quebec City (+26%), and Saguenay (+17%), where, unsurprisingly, sellers still hold the upper hand in negotiations due to a low inventory of properties for sale.

To watch: The first effects of a potential trade war with the United States?

The Canadian Real Estate Association (CREA) noted in its statement that sales dropped significantly during the last week of January, “likely due to uncertainty surrounding a potential trade war with the United States.”

Another key highlight from the latest resale market data is the 23% increase in new listings across the country last month—a high figure by January standards. This has already led some analysts to wonder whether economic uncertainty prompted some sellers to list their properties earlier than planned. However, it seems too soon to draw such a conclusion. In any case, the surge in listings was most pronounced in British Columbia (+37%), followed—though to a much lesser extent—by Ontario (+26%). In Quebec, the 18% increase in new listings last month appears to be within normal range.

It will be interesting to monitor how the situation evolves, particularly regarding the impact of the ongoing turmoil over a potential trade war with the United States on consumer confidence. At the same time, this uncertainty could also lead to further declines in interest rates—a topic that will be explored in an upcoming post.

![. Après six ans de croissance quasi ininterrompue[1], le nombre de ventes réalisées par les](https://realta.ca/wp-content/uploads/2023/04/4342_GORINI-768x512.jpg)