After lowering its key interest rate by 0.25 percentage points three times since June 5th, the Bank of Canada is very likely to continue with more cuts by the end of the year, during its next announcements on October 23rd and December 11th.

In managing its monetary policy, the Bank of Canada faces a tough choice between keeping prices stable and encouraging economic growth.

However, inflation is no longer the main concern of the Bank of Canada, which is now turning its attention to the economic slowdown, particularly in the labor market.

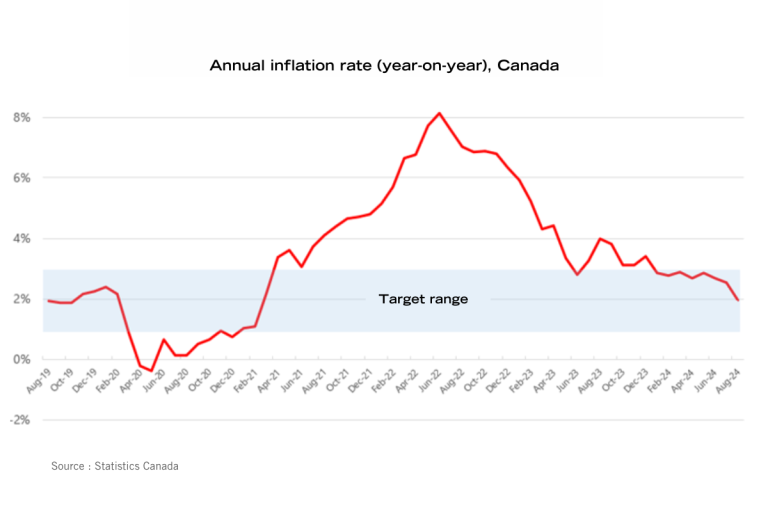

The latest data on the Consumer Price Index shows that inflation has now fallen back into line. In August, inflation was at 2%, which is right in the middle of the Bank’s target range (1% to 3%). However, other economic indicators point to a slowdown, notably the labor market data, which has significantly worsened.

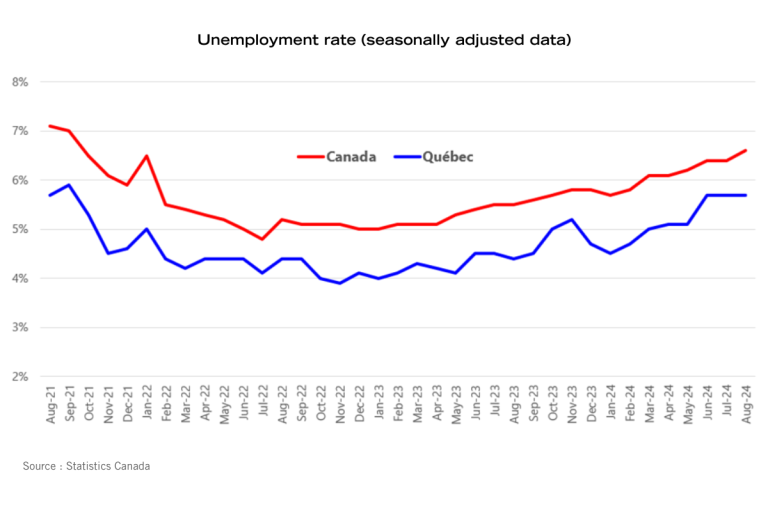

Over the past year, the unemployment rate in Canada has risen from 5.5% in August 2023 to 6.6% in August 2024 (from 4.4% to 5.7% in Quebec during the same period). Around 316,000 jobs were created in the country during this time, but the labor force grew much faster. Moreover, job gains in the past year have mainly come from the public sector, with a relatively weak contribution from the private sector.

To ensure a smooth landing, the Bank of Canada is now wondering if its monetary policy has been too restrictive and is looking to ease it. As a result, the vast majority of economists expect two more 0.25 percentage point rate cuts by the end of the year. Some believe one of these cuts could even be 0.5 percentage points, though this view is not widely shared.

Borrowers have stopped avoiding variable-rate mortgages

The downward trend in the Bank of Canada’s key interest rate is obviously great news for variable-rate mortgage rates. The key rate directly influences the prime rate set by financial institutions, which is the basis for setting variable mortgage rates. When rates were rising, borrowers avoided variable-rate mortgages. With falling rates, they are becoming attractive again.

On the other hand, it’s important to know that 5-year fixed mortgage rates won’t necessarily follow the key rate. These rates are not dictated by the Bank of Canada but rather by the bond market, which determines the cost of funds for financial institutions. Bond rates are influenced by many factors and are currently very volatile. Most experts believe we shouldn’t expect significant drops in 5-year fixed mortgage rates by the end of the year.

* * *