Last December, we shared an optimistic forecast for the year ahead, but we also pointed out one risk: the possibility of a trade war triggered by the Trump administration. Now that this risk has become reality, we’re revising our forecast downward. That said, our outlook remains positive overall, both for sales and prices in 2025.

The trade war could make some buyers more hesitant

The trade conflict with our southern neighbors is clearly raising concerns about a potential economic slowdown. So far, there’s little solid economic data to confirm a slowdown since the first tariffs came into effect in March, except maybe for labour market data, which showed Canada’s unemployment rate rising to 6.9% in April.

The main impact so far seems to be on business and consumer confidence. Businesses are showing less intention to invest, and consumers are more worried about job security, more pessimistic about their financial future, and planning to spend more cautiously, or even delay major purchases. For example, the Conference Board’s Confidence Index shows that the percentage of Canadians who felt it was a good time to make a major purchase dropped from 14.3% in January to 10% in April.

In short, the economic outlook has clearly darkened. But that’s not all…

Interest rates are refusing to come down.

At the start of the year, most experts were expecting interest rates to drop, especially in the spring. And with the economic outlook worsening since then, it would have been reasonable to expect even lower rates. That has indeed been the case for variable mortgage rates, since the Bank of Canada has cut its key rate twice since the beginning of the year. However, fixed rates have not followed the same trend.

Fixed mortgage rates are tied to bond yields, and those have been quite volatile in recent months. The trade conflict is once again a key factor less the one involving Canada and more the broad tariff war the U.S. is waging against some 180 countries, a move President Trump dubbed “liberation day.” On one hand, inflation expectations have jumped due to retaliatory measures from other countries, especially the escalating tariff dispute with China. On the other hand, global investors have shown less interest in U.S. Treasury bonds. Both of these factors have pushed up U.S. bond yields. And as is often the case, Canadian bond yields have followed.

Higher bond yields mean higher borrowing costs for financial institutions, which in turn impacts the mortgage rates they offer. Also, given the growing risk of a potential recession, lenders seem to be applying wider spreads (the difference between bond yields and mortgage rates) in recent weeks to reflect the added risk.

Still, a very strong start to the year

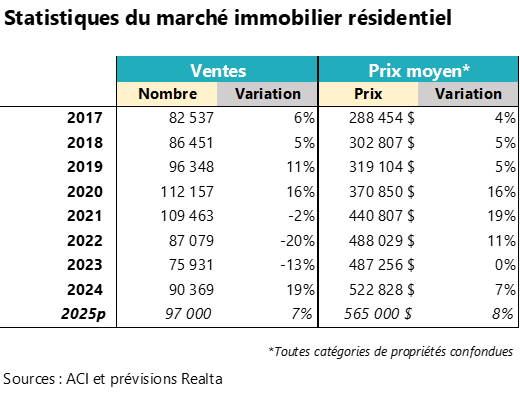

Let’s not forget that the Quebec real estate market is still off to an excellent start this year. In the first four months of 2025, the number of sales grew by 12.2% compared to the same period last year, while the average property price (all categories combined) rose by 8.5%. At the same time, active listings have slightly declined by 4%, tightening market conditions that were already favoring sellers. It’s no surprise, then, that we’re also seeing a rise in bidding wars.

Rising sales and strong price growth

Given the new context we outlined earlier, it will likely be difficult to maintain the same pace of activity for the rest of the year, at least in terms of sales. That said, borrowing costs are still lower than they were at the same time last year, and the new mortgage rules (allowing up to 30-year amortization for all first-time buyers) could give the market an extra push.

All things considered, we expect that real estate brokers across the province will complete around 97,000 sales in 2025, a 7% increase compared to 2024. As for price growth, it’s unlikely to slow down, since sellers will likely keep the upper hand in negotiations—even if listings start to rise.

Some job losses are expected in sectors hit harder by tariffs (such as steel, aluminum, automotive, and energy products), which could force certain homeowners to sell. However, we believe these cases won’t be numerous enough to shift the market into balanced or buyer’s territory—except perhaps in areas where the economy is less diversified.

[1] At the time of writing, the latest data on GDP, retail sales, and investments was only available up to February.

[2] Source: Business Outlook Survey, Bank of Canada, April 2025.

[3] Source: Canadian Survey of Consumer Expectations, Bank of Canada, April 2025.

[4] Source: CREA (Canadian Real Estate Association)

[5] Apart from a few changes to the Employment Insurance program, it is still unclear what support measures governments might introduce for workers affected by the tariffs.