Why should we shift our focus towards new construction?

The very first principle in economics states that scarcity determines price. If the prices of residential properties have surged over the past two decades in Quebec (from 2001 to 2022, prices have more than tripled), it’s because the supply of properties for sale was inadequate compared to the demand, resulting in market conditions that have almost always favored sellers. Of course, the downward trend in borrowing costs since the turn of the decade has stimulated demand. However, if, in parallel, the supply has also proven to be insufficient, it is not exclusively a cyclical phenomenon. From a structural standpoint, there is a housing deficit in Quebec, which is the result of several years of underconstruction.

There is now a strong consensus among experts stating that, for at least a decade and perhaps more, residential construction in Quebec, as in the rest of the country, has been significantly insufficient in relation to the formation of new households. For example, according to the APCHQ, there were already at least 100,000 housing units missing in Quebec by the end of 2021 to restore balance to the market.

A significant housing deficit

According to the latest projections from the CMHC, by 2030, if the pace of construction remains the same, there could be a shortage of up to 860,000 housing units of all types in Quebec to restore affordability in the real estate market (for owner-occupiers and renters). This is what emerges from a report updating the housing shortage in Canada published last September.

To fill this gap, we would need to start construction on nearly 150,000 housing units per year by 2030. However, even during its best years, residential construction has never exceeded 75,000 starts in Quebec (the record being 74,179 in 1987), which is only half of the target.

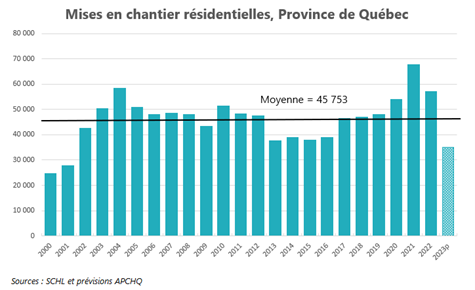

The graph below shows that we have built an average of just under 46,000 housing units per year since 2000. Therefore, we would need to triple the annual construction rate until 2030 to hope to reach the goal. However, the situation is rather worsening. Far from accelerating, following a significant increase in construction costs since the pandemic and rising financing costs, housing starts are declining. In 2023, we are heading towards the worst year for residential construction in Quebec since 2001 and possibly the largest decline in a single year since data has been compiled by the CMHC (1955).

[1] “What is the Extent of the Housing Deficit in Quebec?” Housing Bulletin, APCHQ, April 2022.

[2] After three quarters in 2023, the lag was around 37% compared to 2022 (source: CMHC).

Impact on the resale market

So far, prices have remained relatively resilient on the resale market despite the rapid rise in mortgage rates, largely because chronic inventory shortages have structural origins. Despite rising financing costs and slowing sales, we are still in a seller’s market during negotiations.

Therefore, as soon as mortgage rates normalize, we may quickly see upward pressure on the prices of existing properties. Our housing deficit will not be resolved in the short or medium term. Even if financing costs decrease, there are too many delays, regulatory obstacles, and public charges currently affecting new buildings for supply to adjust quickly to demand. Also, even if governments take aggressive measures to boost construction starts and attract a massive workforce to the construction sector, it will still take time for this to translate into habitable homes.

In parallel, demand will remain strong. The widespread labor shortage we are currently experiencing requires us to recruit foreign workers, leading to an explosion in our net migration (in 2022, we welcomed a record number of nearly 150,000 newcomers, including non-permanent residents). This is likely to continue.

In summary, be prepared for property prices to rise once again once the current cyclical storm is behind us.